How to License a Business in the UAE: A Comprehensive Guide

Starting a business in the UAE is a promising venture due to the country’s robust economy and strategic location. However, licensing your business is a critical step to ensure legal compliance and consumer protection. A business license in the UAE confirms that the company meets all necessary standards and regulations. Consulting with a business setup consultant in UAE can greatly assist in navigating this process. Here’s a detailed guide on how to license your business in the UAE:

Step-by-Step Process to License Your Business in the UAE

1. Select Business Jurisdiction and Structure

- Local (Mainland) Companies: These companies can operate anywhere in the UAE and can conduct business directly with the local market. They require a local sponsor who owns 51% of the business, although there are some exceptions for certain professional licenses.

- Free Zone Companies: These companies operate within designated free zones and offer benefits like 100% foreign ownership, tax exemptions, and customs privileges. They are ideal for businesses that primarily serve international markets and require a strategic location with excellent logistics.

- Offshore Companies: These are established for conducting business outside the UAE and are not permitted to carry out any business activities within the UAE. They are often used for asset protection, holding, and international trade.

2. Select and Register a Company Name

The company name must comply with UAE regulations. It should not include any offensive words or religious references and must reflect the nature of the business. Additionally, the name should be unique and not already registered by another entity.

3. Apply for a License

Depending on the business activity, the type of license required may vary. Here are the common licenses:

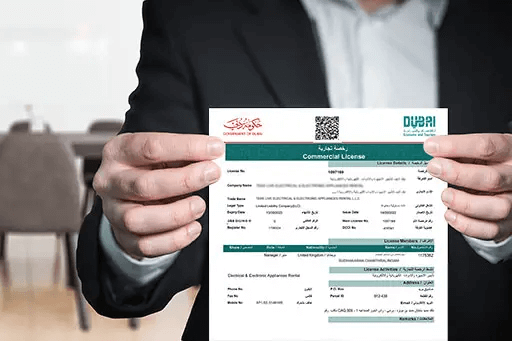

- Commercial License: For trading activities (goods and services) both domestically and internationally. This includes general trading, import and export, and retail operations.

- Professional License: For service providers, artisans, and professionals. This license is issued to individual practitioners or companies offering specialized services such as consultancy, legal services, and healthcare.

- Industrial License: For manufacturing and industrial operations. This is required for businesses involved in production, manufacturing, and processing activities.

- Tourism License: For managing hotels, restaurants, travel agencies, and other tourism-related services. This includes tour operators, travel agencies, and event management companies.

For mainland companies, applications are submitted to the Department of Economic Development (DED). For free zone companies, applications are submitted to the respective free zone authority.

Detailed Licensing Information

Mainland (Local) Companies

Licensing Authority: Department of Economic Development (DED)

License Validity: Typically, licenses are valid for one year and need annual renewal.

Requirements for Renewal:

- Confirmation of compliance with legal requirements.

- Renewal of company premises lease.

- Payment of government fees.

Free Zone Companies

- Licensing Authority: Respective Free Zone Administration

- License Validity: Similar to mainland, licenses generally require annual renewal.

- Additional Requirements: Depending on the business activity, additional permissions from other authorities like the Ministry of Tourism or Ministry of Health may be needed.

Offshore Companies

Licensing Exemption: Offshore companies do not need a license for operations within the UAE.

License Renewal Process

- Timely payment of government fees.

- Renewal of the lease for company premises.

- Submission of financial statements or balance transfer.

- Obtaining a No Objection Certificate (NOC) if required.

Failure to renew the license on time can result in fines, suspension of business activities, or even closure of the company’s bank account.

Additional Considerations

Activity Description

To determine the appropriate license, a detailed description of the company’s activities is essential. This helps in aligning with the right category and ensuring compliance with regulations.

Professional Consultation

Given the complexity of the licensing process, consulting with a professional or a business setup advisor is recommended. They can provide tailored advice based on the specific needs of the business and help navigate through the regulatory requirements efficiently.

Special Permissions

For certain activities, additional permissions from relevant authorities may be required. For example, healthcare-related businesses may need approval from the Ministry of Health, while tourism-related businesses might need permissions from the Ministry of Tourism.

License Renewal

- Timely Renewal: Ensuring timely renewal is crucial to avoid fines and operational disruptions.

- Document Submission: Required documents and fees must be submitted to the relevant authorities before the license expires.

Detailed Process for Obtaining a Business License in the UAE

1. Business Plan Development

A well-structured business plan is crucial for obtaining a business license in the UAE. The plan should include detailed descriptions of the business activities, market analysis, operational plan, financial projections, and the organizational structure. This document serves as a blueprint for the business and is often required by licensing authorities to understand the scope and viability of the proposed business.

2. Legal Structure and Jurisdiction Decision

Deciding on the legal structure (sole proprietorship, partnership, limited liability company, etc.) and jurisdiction (mainland, free zone, offshore) is the next critical step. Each structure and jurisdiction offers different benefits and limitations, impacting ownership, taxation, and operational flexibility. Consulting with legal and business setup experts can provide valuable insights into making the right choice.

3. Trade Name Reservation

After deciding on the business structure, the next step is to reserve the trade name. This process involves submitting the chosen name for approval to ensure it meets the regulatory guidelines and is not already in use. The trade name should be unique, relevant to the business activities, and free from any prohibited terms.

4. Initial Approval

Obtaining initial approval from the relevant authorities is a prerequisite before proceeding with the licensing process. This step involves submitting preliminary documents such as passport copies of shareholders, a brief business description, and a filled application form. The initial approval signifies that the business activities are permissible and can move forward to the next stages.

5. Drafting the Memorandum of Association (MOA)

For certain business structures, particularly LLCs, drafting the Memorandum of Association (MOA) is mandatory. The MOA outlines the company’s structure, ownership distribution, business activities, and management roles. It must be notarized and submitted to the relevant authorities as part of the licensing process.

6. Leasing Business Premises

Securing a physical address for the business is a crucial requirement for obtaining a business license. The premises should comply with the zoning regulations of the chosen jurisdiction. A tenancy contract or Ejari certificate (for Dubai) must be provided as proof of the leased premises.

7. Additional Approvals and Certifications

Depending on the nature of the business, additional approvals and certifications may be required from relevant ministries and regulatory bodies. For example, businesses in the healthcare sector need approval from the Ministry of Health, while food-related businesses require clearance from the Food Control Department.

8. License Issuance and Registration

Upon fulfilling all requirements, the final step is to submit the complete application package, including all necessary documents, to the relevant authority. The licensing authority will review the submission, and upon approval, the business license will be issued. The business must also be registered with the Chamber of Commerce.

9. Post-Licensing Compliance

After obtaining the license, businesses must adhere to ongoing compliance requirements, including maintaining proper accounting records, renewing the license annually, and adhering to labor laws and regulations. Non-compliance can result in penalties or license suspension.

Additional Tips for Business Licensing in the UAE

1. Understand the Market

Conduct thorough market research to understand the demand, competition, and regulatory environment for your business in the UAE. This helps in making informed decisions and developing a strong business strategy.

2. Leverage Free Zones

If your business primarily serves international markets, consider setting up in one of the UAE’s numerous free zones. These zones offer significant benefits, including tax exemptions, full foreign ownership, and streamlined administrative processes.

3. Utilize Professional Services

Engage professional services, including legal advisors, business consultants, and PRO services, to navigate the complexities of the licensing process. Their expertise can save time, reduce errors, and ensure compliance with all regulatory requirements.

4. Plan for Renewal

Develop a system for tracking license renewal deadlines and requirements to avoid penalties and disruptions. Regularly review compliance with licensing conditions and ensure timely submission of renewal applications and fees.

5. Network and Collaborate

Join local business networks and chambers of commerce to build connections, gain insights, and access resources that can support your business growth. Collaboration with other businesses can also provide opportunities for partnerships and expansion.

Conclusion

Licensing a business in the UAE involves several critical steps, from selecting the right business structure and jurisdiction to applying for the correct license and ensuring timely renewals. By understanding these steps and the associated requirements, businesses can operate smoothly and legally within the UAE’s dynamic market. Consulting with professionals and keeping abreast of regulatory changes can further streamline the process, ensuring that your business remains compliant and successful. The UAE’s favorable business environment, strategic location, and supportive regulatory framework make it an attractive destination for entrepreneurs and investors worldwide.

With over a decade of writing obituaries for the local paper, Jane has a uniquely wry voice that shines through in her newest collection of essays, which explore the importance we place on legacy.